Soybean Market Update | February 2023

Feb 14, 2023

Article Provided by: Scotty Yerges

Soybean bulls should have optimism after reading South America’s production on the February world agricultural supply and demand estimates (WASDE) report. The USDA lowered Argentina’s soybeans production by 4.5 million metric tons (MMT) to 41 MMT and cut exports by 1.5 MMT. Argentina’s Rosario Grain Exchange estimates soybean production at 34.5 MMT, well below the USDA number. The USDA left Brazil’s soybean production at 153 MMT, when some traders believed the number would increase. Lower world ending stocks from the January report also helped support the market.

Soybean bears saw some numbers to support their position in the February WASDE report as well, most notably an increase in U.S. soybeans ending stocks. This increase from January’s estimate was driven by a decrease in soybean crush by 15 million bushels. It is also important to note Brazil’s increase in soybean exports by 1 MMT. Foreign markets are looking to Brazil as a cheaper market than the U.S. and it is showing in the U.S. export sales report. Soybean exports are down 38% from last week and down 49% from the last four week’s average.

Weather:

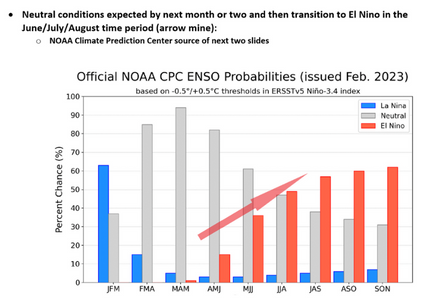

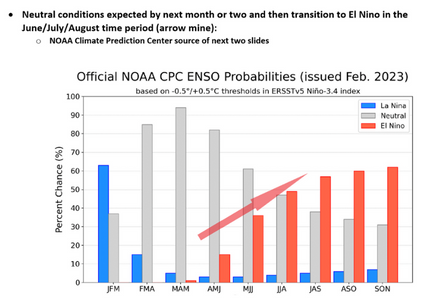

As we move into the late spring and summer months, the weather pattern is expected to change from a La Nina pattern where the Southern Hemisphere is wetter to a more neutral pattern and then begin shifting to an El Nino pattern where the Northern Hemisphere is wetter. Will a good production year be able to refill the tight stocks from a year ago? What will a big U.S. soybean crop do to the market when the foreign market is looking elsewhere? Having a marketing plan in place to protect profit for the 2023 crop year is very important.

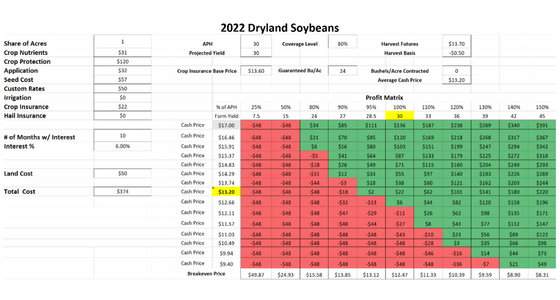

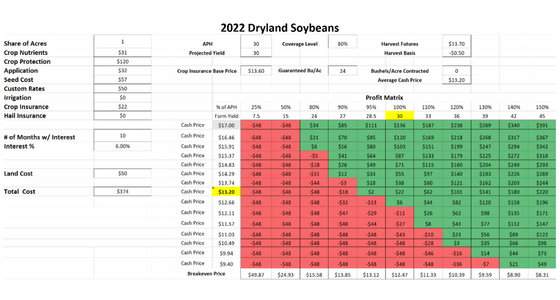

Here is a dryland soybean profitability matrix for 2023 soybeans with an APH of 30 bu/ac with a coverage level of 80%. There are opportunities to lock in profit at current 2023 prices and other options available to lock in a floor in the market.

Locking in profitability during periods of high input prices is critical to farm success. High prices typically cure high prices. The best way to lock in profitability is to do a hedge to arrive (HTA) contract. This will lock in the futures price and keep basis and delivery location open. After 2022, end users are in demand for grain and their best opportunity to buy it will be during harvest. Locking in a profitable futures level with basis upside is a good strategy to ensure profitability. Buying a put option will lock in a profitable floor with unlimited futures upside. This contract will have an investment, but being able to capture upside in the market will be beneficial if prices rise again this year.

Soybean bulls should have optimism after reading South America’s production on the February world agricultural supply and demand estimates (WASDE) report. The USDA lowered Argentina’s soybeans production by 4.5 million metric tons (MMT) to 41 MMT and cut exports by 1.5 MMT. Argentina’s Rosario Grain Exchange estimates soybean production at 34.5 MMT, well below the USDA number. The USDA left Brazil’s soybean production at 153 MMT, when some traders believed the number would increase. Lower world ending stocks from the January report also helped support the market.

Soybean bears saw some numbers to support their position in the February WASDE report as well, most notably an increase in U.S. soybeans ending stocks. This increase from January’s estimate was driven by a decrease in soybean crush by 15 million bushels. It is also important to note Brazil’s increase in soybean exports by 1 MMT. Foreign markets are looking to Brazil as a cheaper market than the U.S. and it is showing in the U.S. export sales report. Soybean exports are down 38% from last week and down 49% from the last four week’s average.

Weather:

As we move into the late spring and summer months, the weather pattern is expected to change from a La Nina pattern where the Southern Hemisphere is wetter to a more neutral pattern and then begin shifting to an El Nino pattern where the Northern Hemisphere is wetter. Will a good production year be able to refill the tight stocks from a year ago? What will a big U.S. soybean crop do to the market when the foreign market is looking elsewhere? Having a marketing plan in place to protect profit for the 2023 crop year is very important.

Here is a dryland soybean profitability matrix for 2023 soybeans with an APH of 30 bu/ac with a coverage level of 80%. There are opportunities to lock in profit at current 2023 prices and other options available to lock in a floor in the market.

Locking in profitability during periods of high input prices is critical to farm success. High prices typically cure high prices. The best way to lock in profitability is to do a hedge to arrive (HTA) contract. This will lock in the futures price and keep basis and delivery location open. After 2022, end users are in demand for grain and their best opportunity to buy it will be during harvest. Locking in a profitable futures level with basis upside is a good strategy to ensure profitability. Buying a put option will lock in a profitable floor with unlimited futures upside. This contract will have an investment, but being able to capture upside in the market will be beneficial if prices rise again this year.